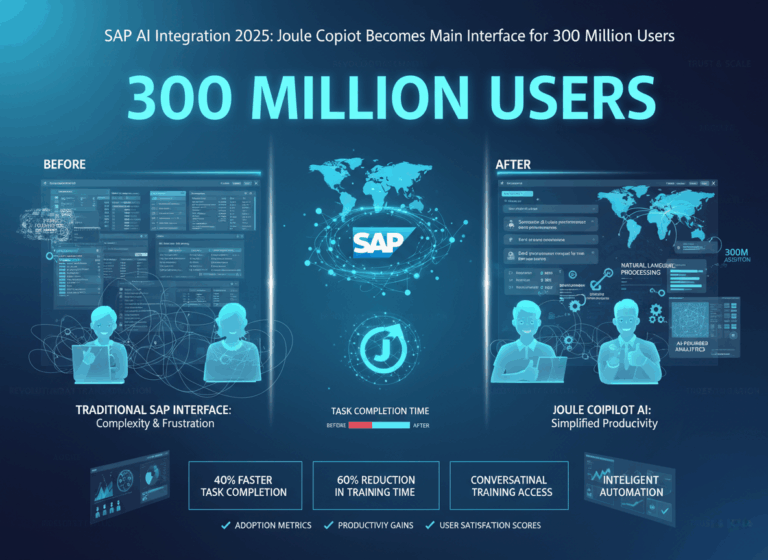

Enterprise risk intelligence 2025 transforms reactive assessments into predictive foresight through AI integration. Workday research documents that 98% of CEOs report immediate business benefit from AI implementation. Companies gain real-time predictive approaches to risk traditional methods cannot match. Historical data combines with current conditions and external threat intelligence forecasting future scenarios.

Our secure AI services implement enterprise risk intelligence 2025 across organizational functions comprehensively. The platform analyzes financial, cybersecurity, and reputational risks providing actionable insights. Businesses act proactively rather than reacting to materialized threats.

PwC 2025 ESG Pulse reports 49% of large enterprises use AI analytics for scenario planning. ERM Academy analyses show that adaptive architecture enables critical decision-making speed in volatile environments. Enterprise risk intelligence 2025 fuses AI automation with human expertise systematically.

Why Enterprise Risk Intelligence 2025 Matters

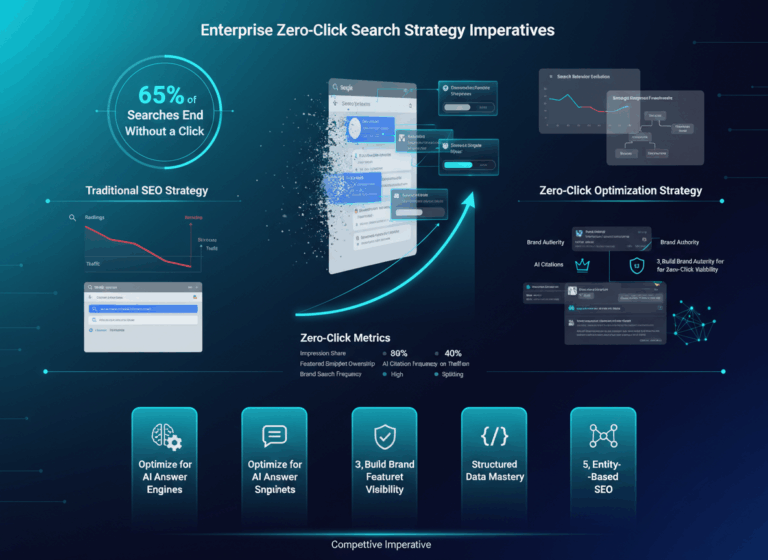

Traditional risk management operates on lagging indicators and periodic assessments. Risk registers update quarterly missing fast-evolving threats. Human analysts cannot process vast data volumes identifying subtle patterns. Reactive approaches respond after damage occurs wasting mitigation opportunities.

Enterprise risk intelligence 2025 provides real-time detection analyzing datasets continuously. AI spots fraud as transactions occur not weeks later during audits. Pattern recognition uncovers emerging risks human analysts overlook. Predictive models forecast threats days or weeks before manifestation.

Supply chains receive early alerts about instability and regulatory changes. Vendor security posture shifts trigger proactive assessment. Climate forecasts combined with shipping data anticipate bottlenecks. Our platform integrates diverse data sources for comprehensive risk visibility.

4 Core Enterprise Risk Intelligence 2025 Capabilities

1. Real-Time Risk Detection

AI analyzes transaction streams detecting fraud patterns instantaneously. Anomaly detection algorithms identify deviations from normal behavior. Threat intelligence feeds provide external context for internal events. Enterprise risk intelligence 2025 eliminates detection lag through continuous monitoring.

Cybersecurity risks surface through network traffic analysis automatically. Compliance violations trigger alerts preventing regulatory penalties. Operational risks emerge from sensor data and process metrics. Organizations respond before risks escalate into incidents.

2. Predictive Risk Forecasting

Machine learning models forecast financial risks analyzing market trends and economic indicators. Historical incident data trains algorithms predicting future occurrence likelihood. Scenario analysis evaluates potential risk impacts across timeframes. Enterprise risk intelligence 2025 enables proactive mitigation before materialization.

Credit risk assessments incorporate alternative data sources improving accuracy. Market volatility predictions inform hedging strategies systematically. Regulatory change anticipation allows compliance preparation. Our pricing includes predictive modeling for all risk domains.

3. Third-Party Risk Intelligence

Vendor risk monitoring combines financial health, cybersecurity posture, and compliance status. Continuous assessment replaces annual questionnaires with real-time intelligence. Supply chain vulnerabilities receive systematic identification and mitigation. Enterprise risk intelligence 2025 extends visibility beyond organizational boundaries.

Geopolitical risk analysis evaluates supplier location stability. Satellite imagery detects supply chain disruptions before official reports. News monitoring identifies vendor incidents requiring investigation. Organizations maintain supply chain resilience through predictive oversight.

4. ESG Risk Analytics

Environmental risk assessment incorporates climate data predicting physical impacts. Social risk monitoring tracks labor practices and community relations. Governance risk analysis evaluates board composition and executive behavior. Enterprise risk intelligence 2025 addresses stakeholder expectations comprehensively.

Regulatory compliance automation ensures environmental reporting accuracy. Reputation risk detection monitors social media and news sentiment. ESG scenario planning evaluates strategy resilience across futures. Contact us for ESG risk implementation guidance.

Balancing AI with Human Expertise

AI accelerates data processing and pattern recognition beyond human capability. Algorithms identify correlations humans miss in complex datasets. Continuous monitoring provides vigilance humans cannot sustain. Enterprise risk intelligence 2025 augments not replaces human judgment.

Human oversight validates AI findings preventing false positive cascades. Strategic context interpretation requires business understanding AI lacks. Ethical considerations and risk appetite decisions remain human responsibilities. Our mission emphasizes responsible AI through human-AI collaboration.

Risk committees evaluate AI recommendations within organizational context. Model governance ensures algorithms remain aligned with business objectives. Continuous training improves both AI systems and human capabilities. Organizations achieve optimal outcomes through integrated intelligence.

Conclusion

Enterprise risk intelligence 2025 delivers 98% CEO-validated business benefit through AI. Reactive risk management transforms into predictive foresight systematically. Organizations without AI-powered risk intelligence face systematic blind spots. Real-time detection and predictive forecasting become competitive necessities.

Implement enterprise risk intelligence today. Varna AI delivers proven risk management solutions for global enterprises. Our platform combines predictive analytics with operational integration. The future of risk management is real-time, predictive, and continuously learning.